In the competitive world of financial services specifically the lending industry, where innovation and efficiency are the lifeblood of success, one question keeps C-level executives awake at night: How do we scale our operations without compromising on stability or customer experience? For a leading non-banking financial company (NBFC), this question became a pressing reality when faced with the monumental task of migrating more than 25 Million loans to a next-generation lending platform.

The Pain Points: A Looming Challenge

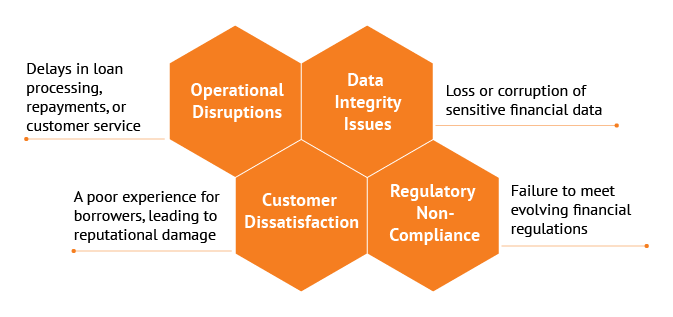

Every executive knows the risks of large-scale migrations: downtime, data loss, operational disruptions, and the potential fallout with customers. For the Financial Institution, the stakes were even higher. With 25 Million+ loans under management, the migration had to be flawless.

Any misstep could lead to:

The Financial Institution’s expectation from Pennant was to successfully navigate the challenges while migrating such a large loan portfolio while ensuring business continuity and future scalability.

The Solution: A Phased Approach to Seamless Migration

At Pennant, we undertook a carefully crafted, phased approach designed to mitigate risks and ensure success at every step.

Phase 1: Learning Through Challenges

The first phase involved migrating 10 million active loans. Despite rigorous planning, challenges emerged during End-of-Day (EOD) processes. Certain batch operations took longer than expected, and caused delays in due date presentment downloads and its receipts.

Instead of panicking with the gargantuan challenge, the team conducted a thorough investigation, identified the root cause, and implemented data repair patches. The result? A fully restored system and a stronger, more resilient platform. This phase wasn’t just about migration; it was about learning and adapting.

Phase 2: A Smoother Transition

Armed with insights from Phase 1, Pennant proactively addressed all prior concerns before initiating the second phase. This time, more than 16 million active loans were migrated. The improvements paid off—only minor issues related to EOD and Statements of Account (SOA) were reported, all of which were resolved swiftly on-site.

This phase marked a turning point. The Financial Institution (NBFC) saw firsthand how Pennant’s platform could handle complexity and huge volume with ease, ensuring operational continuity and customer satisfaction.

Phase 3: Setting New Benchmarks

The third phase involves migrating millions of other active loans. With refined processes and key learnings in place, we are set to execute this seamlessly—paving the way for future migrations to be effortless and setting new benchmarks for operational excellence..

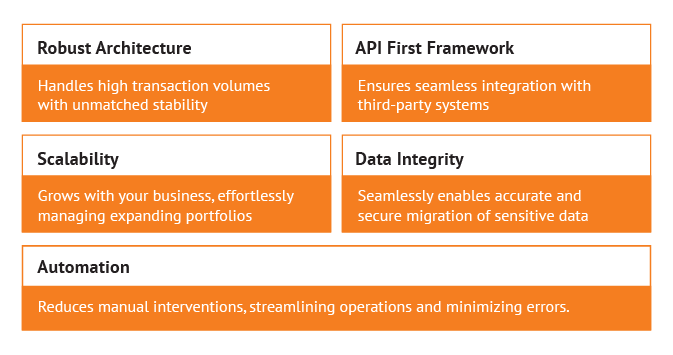

The Technology: Built for the Future

At the heart of this success is Pennant’s future ready, end to end Lending Lifecycle Platform, pennApps Lending Factory – a next-generation solution designed to meet the demands of modern fintech. Here’s what makes it stand out:

The Human Touch: Collaboration and Commitment

While technology played a pivotal role, the real hero of this story was our team. The team worked hand-in-hand with the Financial Institution, addressing challenges proactively and ensuring a smooth transition. Their commitment to excellence and customer-centric approach turned a daunting task into a resounding success.

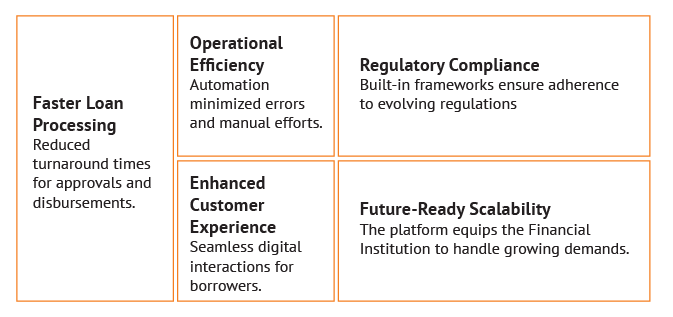

The Impact: Beyond Migration

This migration wasn’t just about moving data—it was about transforming the Financial Institution’s operations and positioning it for future growth. The results speak for themselves.

A Story of Trust and Transformation

For C-level executives, the takeaway is clear: Migration doesn’t have to be a nightmare. With the right partner, it can be a transformative journey that strengthens your lending operations, enhances customer experience, and positions your organization for future success.

Pennant Technologies didn’t just migrate 25 Million+ loans, it delivered a future-ready platform that empowers the financial institution to innovate, grow, and thrive in an increasingly competitive landscape.

Recent Blogs

In the spotlight