The tale of the Australian non-bank lending sector is one of resilience.

The space, accounting for 5% of the total financial system of Australia , has grown consistently despite challenging economic conditions. How? As Aaron Bassin, founder of Bridgit, a non-bank lender, puts it, “(non-bank lender’s) continued rise is, in part, due to their product diversity and specialisation of a market niche (underserved borrowers), making them a viable alternative to the traditional home loan.”

Non-traditional lenders (including non bank lenders, Credit Unions, Mutuals, embedded finance platforms and asset financiers) serve market segments, product mixes & communities that have been historically underserved by banks. Furthermore, when faced with a challenge, they rise to the occasion.

For instance, when borrowers were under financial duress due to the RBA-mandated interest rate hike, the non-traditional lending sector provided respite through relevant and timely personal loan & BNPL products and human-first customer service experiences. Besides, they were among the first financial institutions that made the lending origination and onboarding process simpler for their customers.

By offering their customers the flexibility to choose a loan plan that suits them and simplifying the loan lifecycle experience , non-traditional lenders have earned a customer base for themselves, chewing away market share from mainstream banks. However, that hasn’t granted them a fighting chance of scaled sustenance yet. With the impending Treasury review on CDR (Consumer Data Rights) expansion into the Non Bank Lenders (https://treasury.gov.au/consultation/c2023-434434-expansion) , Open Banking will provide an additional level playing field opportunity to them to compete for Deposits (& hence Lending) wallet-share, although, this will come with increased ASIC/Treasury scrutiny on CDR compliance overheads for them to manage.

Non-traditional lenders must must overcome challenges posed by limited capital, impending removal of serviceability buffers, and loan lifecycle management to have a fighting chance of survival

1. Lower Capital Budgets available for scale & expansion

Traditional banks are larger, older and well-structured companies with several millions of dollars worth of funds. Besides, they can lean into federally insured deposits for additional financing in trying times. That means, they can get away with excess spend without worrying about a dent in their financial reserves.

During the rear end of last year, when interest rates were at an all-time high, traditional banks, including ANZ and Westpac were offering cashbacks ranging from $2000 to $4000 to entice people into refinancing with them. This was additional investment for traditional banks to earn customers. What’s more, it worked.

Non-traditional lenders, in contrast, cannot afford such spending, given their smaller size, lower budgets, and minimal funding. For instance, P&N Bank would need at least 15 billion AUD in total assets by 2025 to compete against majors.

However, that hasn’t clipped the wings of some non-traditional lenders. Challengers like Athena envision running their loan-processing platform at less than half the cost of traditional lenders. They aim to achieve this by making smart funding decisions, and investing in tech to simplify their loan processes.

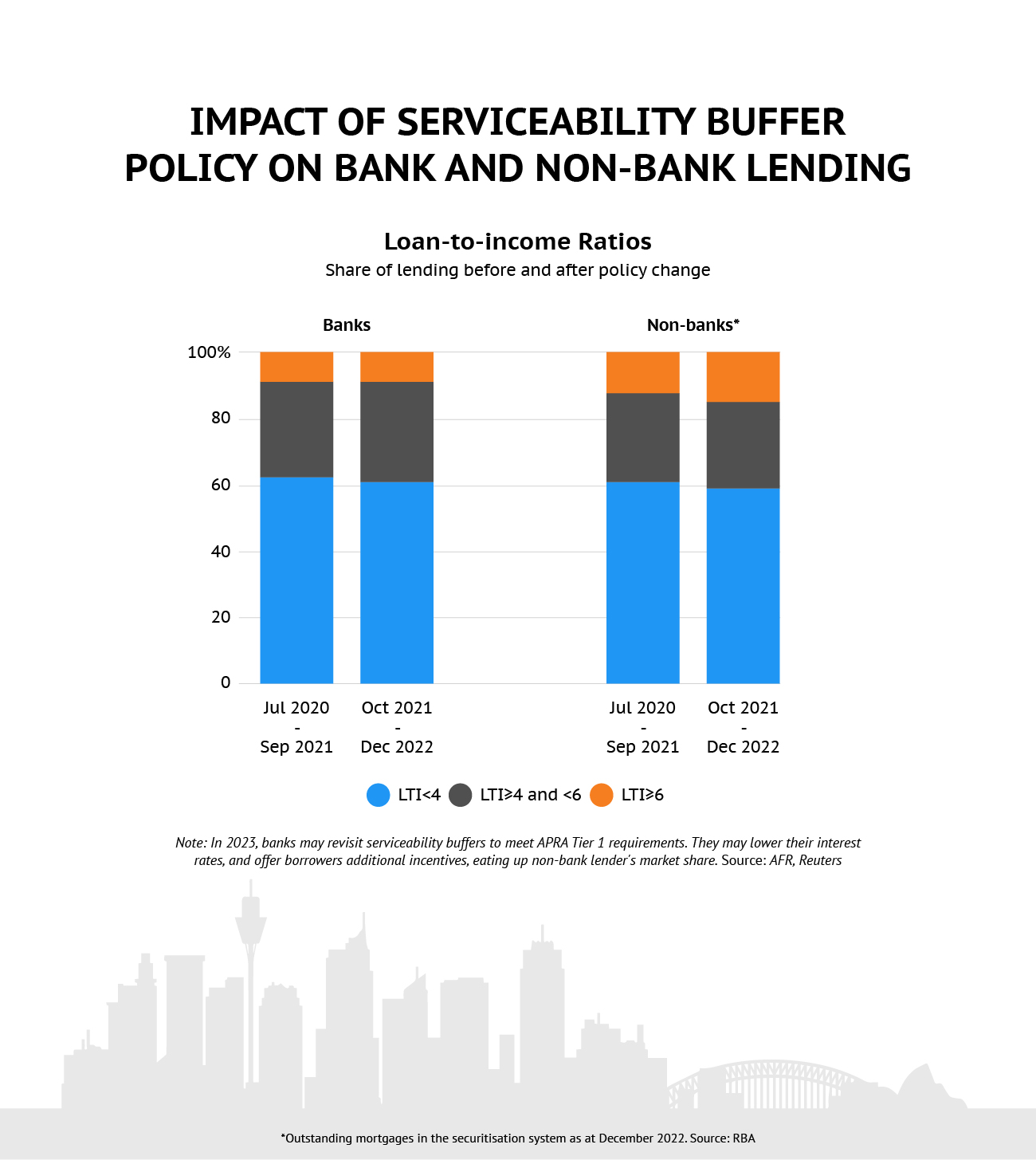

2. Recalibration of the Serviceability Buffer

Non-traditional lenders have largely differentiated themselves from traditional banks in the refinancing space through better loan offers alongside a convenient borrowing experience. That’s because non-traditional lenders have had the power to decide their interest rates unlike traditional banks that must follow APRA stipulations.

While this worked in favour of the non-traditional lenders at the start of the recent interest rate hikes, now that the banks are revisiting the serviceability buffers to meet APRA Tier 1 capital requirements, traditional banks may lower their interest rates too.

All of this means that to earn new business, non-traditional lenders will have to lower their interest rates further over offering their customers flexible loan terms and personalised loan products. Also, when financially stressed borrowers show up, they must offer appropriate financing options while taking over delinquency risk.

That said, some non-traditional lenders have managed to use technology to overcome lending challenges. MoneyMe, for instance, used an AI-powered technology platform and reported a record statutory NPAT of $9 million in the tumultuous first half of 2023.

3. Loan Lifecycle Management

Borrowers don’t want to lose out on a chance to buy their dream home, especially in a housing market like Australia. Most non-traditional lenders capitalise on this borrower behaviour and prioritise delivering loans quickly. Many have quick Loan Origination Systems to help with this. Case in point, institutions like Pepper Money, Athena and other Digital Non-Bank lenders are known to help borrowers get their applications approved within minutes, thanks to their LOS.

Additionally, given non-traditional lenders extend financing to underserved segments, they are likely to encounter more delinquent borrowers. Most already have robust hardship planning & arrear servicing processes to manage them.

However, relying on discrete lending systems for loan origination and arrear servicing mechanisms is no longer sustainable, especially when competitors are streamlining entire loan processes, from originations, to delinquency management to collections, through modular modernisation of core banking systems. What non-bank lenders then need is a comprehensive system to simplify loan management end-to-end, to simplify their borrower’s lending experience. Loan Management & servicing Systems can help with this.

Specialised LMS systems help reduce setup costs, streamline loan borrowing, beyond origination

1. Lower Setup Costs

Unlike core banking transformations that require extensive funding, developer input, continuous maintenance and multi-vendor communication, loan management systems or LMS are modular, composable and easier to integrate with core, book of record systems.

They come with a pre-built framework, reducing development and set-up costs. Besides, since most LMS providers bundle maintenance and updates with their packages, upkeep is easier as well.

2. Modularity

Loan management systems are third party loan software that integrate with existing loan origination and servicing systems, integrate functions, and streamline them to make the borrowing experience convenient for borrowers.

They are developed to be compatible with multiple applications and have APIs and connectors for quick and efficient data exchange. This not only prevents the disruption of existing processes but also minimises the time to functioning greatly, also allowing for product diversity & innovation through the borrower’s lifecycle moments of truth.

3. Simplified Loan Lifecycles

Financial institutions that do not implement loan management systems often suffer from greater churn. That’s often because they coincidently also have disjointed systems that do not integrate well. This, in turn, makes retrieving customer information and using data to provide a better service difficult, eroding the client experience while increasing the cost to service a loan.

Implementing a modular, lego-block based loan servicing / management system, in contrast, simplifies every aspect of the loan lifecycle, from origination to loan restructuring, delinquency management and collections , oftentimes through tech and automation. This reduces the length of the loan cycle and makes for an enjoyable borrowing experience.

Non-bank lenders have long focused on providing underserved borrowers with a top notch loan origination experience through innovative product offerings and a seamless onboarding experience. However, they have not had a chance on improving the customer experience beyond origination, as they have been constrained by legacy core systems.

As traditional banks eye this market and look to capture it by digitising their lending processes, non-bank lenders have no choice but to double down on improving their loan borrowing experience. Loan management systems offer such institutions a cost-efficient and technologically sound way of achieving this goal, helping them survive through tumultuous times.

Recent Blogs