Reflecting on a tumultuous 2023 , the Australian banking industry must embrace hyper-personalisation across the lending value chain, to address borrowers’ needs and navigate through the current economic conditions.

The Australian economy has had a tight-rope walk to undertake, balancing the act between inflationary pressures and mortgage interest rate constraints, on the life of the average borrower household. Almost $370 billion worth of maturing home loans has threatened to create a financial burden for borrowers, potentially impacting housing prices and consumer spending significantly. Though 60% of Australians have saved enough to cover over 3 months of scheduled payments, debt repayments (that includes the mortgage) now consume an alarming 30.1% of disposable income. Traditional lending structures have grappled to match customer needs amidst the growing cost of living.

What is worse still, data from the Reserve Bank of Australia points out that a staggering 30% of Australian Mortgages are on fixed rates, with a majority set to expire by 2023. This could cause problems for borrowers, who may be forced to pay higher repayments if interest rates rise. In an effort to tackle this immense risk, Australian Prudential Regulation Authority (APRA) has urged banks to be equipped for any associated risks from a flood of fixed-rate loans transitioning into more expensive rates – the situation worsened by one of the world’s most high household debt levels at 186.8% (as of 2021) of gross disposable income.

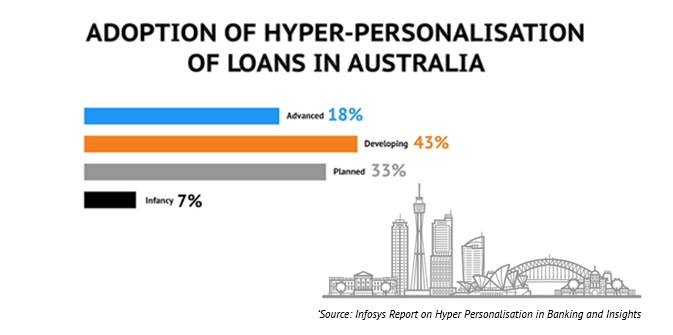

To deal with this tight-rope balancing act, banks have had to embrace hyper-personalisation across all lifecycle moments of truth for their borrowers. This includes the use of advanced lending systems to streamline the loan process. Stakeholders believe accelerating hyper-personalisation efforts not only helps to acquire and retain customers more efficiently but also acts as a lifeline for economic recovery. Two-thirds of banks have already piloted these technologies, aiming to develop closer relationships with their customers, to re-think how they develop and design loan software, and improve productivity and profitability across operations.

Challenges such as data privacy and accuracy, economic constraints, lack of customer-centric approach and competitive pressure hamper the implementation of hyper-personalised lending systems. This includes the need for robust credit underwriting processes and the management of a diverse loan portfolio.

However, only 16% of banks have an effective strategy for digital transformation. Navigating the landscape of hyper-personalisation in lending software comes with its fair share of challenges. From data privacy concerns to economic constraints and the need for a customer-centric approach, this section explores the roadblocks hindering the implementation of tailored lending systems.

Stricter rules and security issues around customer data hinder personalised solutions. 70% of Australians are worried about unauthorised access, misuse, and breaches – valid concerns that lenders must take seriously. Hyper-personalisation must be carefully managed to avoid over-indebtedness. To address these fears, lenders need to ensure ethical and transparent use of customer data with no discriminatory factors in loan decisions and compliance with the Privacy Act 1988 and APRA.

The Reserve Bank of Australia (RBA) stepped in when inflation skyrocketed to 7% in Apr ’23, enforcing strict measures that led to an interest rate hike to an unprecedented 4.10% by June, followed by additional rounds of rate hikes & holds through the year.. These crippling regulations along with high costs and increasing cost-to-income ratio had left borrowers’ wallets strained and caused financial turmoil across the country. Second-tier lenders’ cost-to-income ratio remained high (~60%) and they faced pressure from wage inflation in the medium term. Rising interest rates could threaten mortgage growth as the housing market cools. Banks have had to work quickly and accurately to evaluate SMEs’ individual needs, and design solutions that keep them afloat through fluctuating markets. This includes the use of advanced lending systems to streamline the loan origination and loan management process

The traditional lending approach lacks an empathetic customer-centric focus, at-times constraining individual financial circumstances and preferences, with complicated process bottlenecks. In Australia, 45% of the respondents feel that banks have failed to understand their true desires due to a cookie-cutter approach. During economic downturns, this approach fails borrowers, leaving them dissatisfied. Lenders should prioritise tailored solutions to enhance customer satisfaction.

Lenders need access to accurate, comprehensive data for accurate risk assessment and tailored loan solutions. Without it, they’re left in the dark, with 87% of banks in Australia feeling frustrated. Poor data leads to mispriced loans and dissatisfied customers. To ensure success, lenders must prioritise data integrity, accuracy, updates, and maintenance–the keys to providing relevant loan offerings and exceptional customer journeys.

Competition in the Australian finance sector intensifies as digital players leverage technology for streamlined lending. This wave of disruption is forcing traditional lenders to invest in transformative tech and partner with fintech to employ hyper-personalisation strategies. Embracing the change, CBA has made a commitment to significantly boost its multi-billion-dollar tech budget, inspiring others to follow suit, while National Australia Bank had acquired the mobile ‘neobank’ 86 4007. Smaller players and fintech companies are attracting record levels of investment in the Asia Pacific region. Over the past 4 years, the big 4 lenders in Australia have lost an estimated total of $148B of home and business lending opportunities to smaller competitors. All these factors and more, further intensify the competition, nudging more organisations to adapt to the newer technologies and offerings.

The adoption of hyper-personalisation requires banks to upskill and reskill their employees to adapt to the changing landscape. To do this, they must not only heavily invest in training programs to ensure a proper understanding of ethics around data but also compete not only with each other but also with top technology firms for tech workers. Australia already faces a shortage of 653,000 tech talent by 2030 and banks will need to offer attractive pay packets and unique benefits such as flexible working arrangements to lure them.

Hyper-personalisation has always been in the banking books, but its implementation has been hindered by the challenges mentioned above, especially when key C-Suite stakeholders view hyper-personalisation as a low priority as they want to see immediate results. This poses a direct impact on the ability to win backing and resources for personalisation initiatives. In order to cater to an increasingly tech-savvy, time-constrained and ‘experience-seeking’ population, it is crucial for Banks to realise the significance of hyper-personalisation to avoid losing customers to competitors.

Overcoming these obstacles is crucial to ensure ethical data usage, tailored solutions, accurate risk assessment, and staying ahead of the curve. By addressing these challenges, banks can unlock the full potential of hyper-personalisation, providing exceptional customer experiences and driving success without compromising on scalability.

With the new era of innovation and collaboration, lenders can overcome these challenges and unlock the transformative power of hyper-personalisation

Achieving success in hyper-personalisation throughout the loan lifecycle (inclusive of loan origination, loan servicing, updating loan software, diversifying a loan portfolio), requires a strategic approach. Studies show Banks currently use less than 10% of the data they have to create value – by updating legacy systems, harnessing real-time data analysis, adopting automation, proactively impacting growth opportunities, and incorporating customer focus, banks can unlock the transformative potential of tailored lending experiences.

Banks should deploy advanced technology to power hyper-personalisation in lending. By deploying cloud infrastructure, prioritising an API-first approach and establishing data lakes and warehouses, banks can redefine lending and empower customers with tailored solutions and exceptional services. For example, MoneyMe and Bajaj Finserv offer flexible loan tenures and EMI based on customer needs and repayment capacity providing a superior customer experience.

By leveraging real-time analytics and cutting-edge algorithms, lenders can revolutionise their operations. Data-driven insights into customer behaviour, market trends and government regulations allow for innovative product solutions that satisfy user needs while promoting financial inclusivity. Alternative sources of data enable accurate credit scoring for non-standard profiles as well as targeted support for those in need. Additionally, APIs facilitate flexible systems that keep up with ever-changing consumer demands. National Australian Bank (NAB)’s partnership with fintech company Wisr which provides personalised payment plans for mortgage customers proves how powerful this approach can be when facing economic downturns.

As more banks leverage advanced tools, it is important to ensure these tools are scalable and adaptive amidst the evolving financial landscape. The adoption of automation in existing processes can help facilitate this by bringing about financial literacy and better decision-making among borrowers, streamlining processes, and enabling deeper customer insights for loan officers or customer service reps to provide tailored guidance throughout the customer lifecycle. ANZ Bank’s ANZ Plus banking app serves as a prime example of this mindset. By adopting automation in existing processes, banks can bring about financial literacy, better decision making and streamlined customer experiences.

Hyper-personalisation can help banks identify and target profitable customer segments, leading to improved profitability. By analysing individual financial data, behaviour patterns, and preferences, banks can tailor loan offerings and financial services that align with customer’s needs and maximise their profitability. This targeted approach helps optimise customer acquisition and retention, ultimately driving improved financial performance for banks. Some prominent players in the industry have been very quick to adapt to this! For eg: Westpac’s digital lending platform offers end-to-end mortgage experience with 10-minute application processing, and NAB Now Pay Later offers BNPL using the existing Visa credit card system.

In today’s tech-driven world, success hinges on focussing on customer needs and exceeding their expectations. Banks like Commonwealth Bank of Australia (CBA) are using data and machine learning to customise loan amounts and tailor interest rates and terms to customers’ financial profiles and repayment history thus putting the customer first for a seamless loan application experience.

In short, hyper-personalisation goes beyond lending origination and reflects in other offerings like home, personal and business loans keeping in mind loan servicing, and loan software. It enables lenders to customise loan terms, repayment schedules, and credit provisions based on individual circumstances, enhancing support for borrowers and businesses while aligning with their financial capabilities and risk profiles.

In the face of unpredictable circumstances, lenders must embrace hyper-personalisation and actively explore innovative approaches to provide tailored solutions.

Given the evolving macroeconomic landscape in Australia, anticipation got built as the Reserve Bank of Australia considered balancing interest rate hikes & inflation in the 2nd half of 2023 leading to a slight uptick in delinquencies. However, with the unemployment rate persistently hovering below 4% compounded with a 5.75% rise in minimum wages from July 1, the impact on mortgage delinquencies & arrears was apparently benign.

Although there is debate over the magnitude and speed of change, banks will need to adapt to vastly different employee and customer expectations and embrace automation to keep up with higher volumes of loans. To achieve this, a heavy focus on Hyper Personalisation is the answer, as it provides banks with a clear data-based strategy to navigate this journey – empowering employees and banks to achieve stronger customer centricity and build deeper, long-term collaboration that inspires genuine trust and loyalty.

This decisive shift to customer-centric product innovation with a sharper focus on automation guarantees that lending organisations are resilient in the face of challenges.

Recent Blogs