High volume & financial stress oriented refinancing market emerges with sky-rocketing interest rates, driving the need for modern technology stack in loan management, way beyond conventional loan origination digital interventions

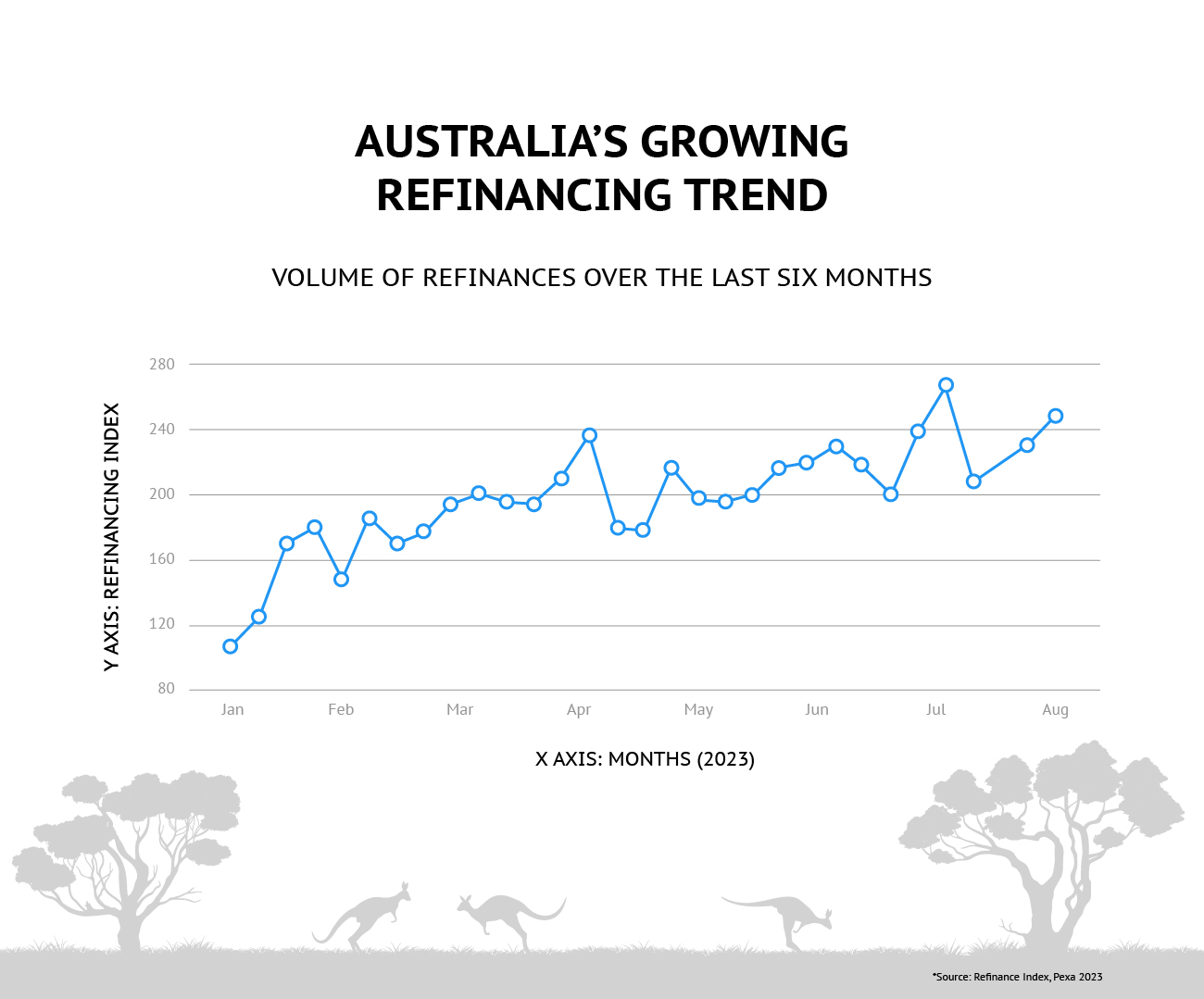

In March 2023, a staggering 28,000 owner-occupiers refinanced their mortgage loans – twice as much as the average over the past two decades. A deep dive into Pexa’s refinancing index will verify this increase since January 2023, a trend that may continue if the RBA continues to increase interest rates (with borrowers hoping that the pause in June & July were not one-off). Long story short, refinancing is on the rise, and steadily at that.

While this should be an opportune situation for cash-rich financial institutions, that’s far from true in today’s tumultuous market.

Borrowers are stuck in a financial fog. Their ‘mortgage cliff’ – in simple terms, conversion of the lower, fixed-interest home loans to higher, variable interest rate loans – while reeling with the aftershocks of inflation, has become a financial quicksand. This has translated into them being desperate for comparatively decimal point lower-interest finance alternatives, while simultaneously being in-eligible for conventional mortgage loans due to low credit worthiness.

Mortgage lenders now face two daunting scenarios. On one hand, those offering lower-interest mortgage refinancing options have a deluge of applications for origination, credit decisioning with recalibrated serviceability criteria. This has impacted processes, from loan origination to loan servicing and serviceability management, especially in organisations using legacy lending systems. On the other hand, financial institutions who want to limit the risk associated with churn and delinquencies, must deal with their market share being eaten up by others, lest they fail to revamp their loan processes to win loyalty from their existing customers.

Establishing market dominance, banks employ aggressive tactics and cashbacks while borrowers navigate loan challenges

Competitive tactics

Although borrowers’ financial woes have increased, lenders have continued to maintain their credit worthiness requirements to ensure they don’t end in the deep end of delinquencies. At a cul-de-sac, borrowers are screening good loan offers while exercising tremendous caution. The competition among lenders for market share has never been higher, and they are leaving no stone unturned to capture it.

As Clancy Yeates, a business reporter, notes, “With the war for mortgage customers heating up, lenders are rolling out the red carpet for borrowers looking to refinance and switch.”

The Big 4 banks are already implementing these tactics and leading the way. They are offering a range of incentives for refinancing, including cashback of $2,000-4,000 (Westpac), free internet and waived fees (Westpac), and frequent flyer points (ANZ)3. Some bankers like Matt Comyn of the CBA are even pushing the ARPA to revisit the 3% serviceability buffer to extend loans to more borrowers.

Some financial institutions are leveraging innovative tools like Sherlok to strike a perfect balance between loan collections and customer retention. Operating across Australia, Sherlok provides financial institutions with data about borrowers at the cusp of refinancing, helping lenders reach out to them with timely loan offers, preventing customer churn.

All these tactics appear to have success in capturing customer attention and loyalty5, however this poses new risks to lenders. Key among them being lenders may be locked-in with risky borrowers for the duration of the refinanced loans. Furthermore, they may hurt their profitability for the loan tenure by spending greater sums to retain risky borrowers.

Navigating digital capabilities for managing delinquency

Lenders are well aware that they are locking in risky customers on skinny margins by way of providing them additional benefits. They also realise that such borrowers are at a higher risk of being delinquent with repayments. Instead of increasing their loan-loss provisions that affect their capital adequacy ratios, and raising their cost per borrower, they are resorting to mitigating delinquencies with technology.

Bank of Queensland, for instance, has an online system to send timely notifications to help collect repayments timely. ME Bank has integrated ‘What-if’ simulation capabilities into their loan processes. This allows borrowers to find an EMI and repayment schedule in line with their financial situation, helping them make repayments on time. Besides that, the tech helps borrowers understand the impact different economic scenarios have on loan repayments, allowing them to choose the right loan.

In addition lenders can use technology to vet borrowers for refinancing more effectively. For instance, as part of responsible lending regulations, all financial institutions today collaborate with Experian, TransUnion and other agencies to get borrower’s credit information before financing a loan, alongside stringent loan serviceability buffers.

High analytics & risk associated with NPAs

Lenders know better than to negate the possibility of delinquencies despite setting up the above delinquency management mechanisms. After all, borrowers can default on loans owing reasons ranging from misutilisation of the loan, unclear corporate structures, high dependence on balance sheets and other creative accounting processes, resulting in the generation of Non-performing assets (NPAs).

This is why they are developing mechanisms to avoid generating NPAs in the first place. Along with issuing mandatory statutory notifications, banks are using technology to prevent the occurrence of loan defaults.

Macquarie Bank uses client data housed on the cloud along with machine learning capabilities to manage defaults and prevent frauds.

One thing is clear – banks are using technology to overcome the challenges like delinquency management and collections in today’s tumultuous economic landscape. In the next section we explore why and how modular systems are the next step in the technological advancement of banking.

Upgrade to modular platforms to streamline operations, boost efficiency, and deliver personalised, and digitally-driven banking experiences that result in increased customer retention

Digital first approach

With more than the majority of Australians preferring digital channels for loan applications and servicing and research suggesting that improved digital experience and faster loan decisioning can reduce fallout rates by 15-30%; banks are looking to provide customers with effortless digital experiences. Unfortunately, traditional lenders are finding it hard to catch up with the rising customer expectations.

Suncorp Group began its digital transformation journey in the midst of the pandemic and faced several challenges, including streamlining existing processes, shifting from legacy loan software, and improving their internal capabilities. Leveraging technology, data and automation, Suncorp Group was not only able to overcome these challenges and improve their customer experience but also able to double their motor and home claims and remove countless questions related to property attributes.

Upgrade to modular platforms

Research by Accenture shows that modular platforms can reduce time-to-market for new products by over 80% compared to legacy systems. While some banks are integrating technology to existing processes, integrating into composable architectures is potentially the more effective way ahead.

Echoing Forrester reports, with modular architecture banks gain the flexibility and speed needed to quickly adapt products and services to customer needs.

ING Bank used Application Programming Interfaces (APIs), to integrate disjointed technologies seamlessly, effectively streamlining their operations. Since each individual module can be modified, updated and swapped, banks like ING can provide a customised banking experience to their customers, and help retain customers.

Bendigo and Adelaide Bank, completed a $450 million core systems overhaul over 7 years, adopting modular tech to improve agility. They tailored the customer experience by using specific modules to appear on their virtual storefront, in turn increasing their satisfaction and retention. Furthermore, by using API-driven modular infrastructure, they were able to build Australia’s first fully cloud-native digital bank in just 14 months.

Alternate solutions

The enormity of the refinancing situation is not lost on Australian lenders. According to the Australian Bureau of Statistics, as of May 2023, the value for external refinancing for total housing rose to $21.0 billion, residential loans, with owner-occupied loans accounting for $14.1 billion and investment loans at $6.8 billion.

But, given the 600 odd banking institutions competing to capture the same target group, lenders also acknowledge the stiff competition.

No wonder, lenders are therefore providing risky loan borrowers with alternate methods to secure financing to expand their share further.

This includes facilities like restructuring, extended loan terms and interest-only payments. Here’s why they work at retaining borrowers.

Now, making provisions for these alternative solutions can mean revamping existing online banking processes for legacy banks. But through a modular architecture, banks can develop new services and products quickly. Commonwealth Bank of Australia (CBA). Leveraging their comprehensive suite of financial hardship solutions—including loan restructuring and interest-only payments—they were able to provide home loan deferrals to over 159000 customers impacted by the COVID-19 pandemic.

Segments like first-time loan buyers that account for 31.6% of total owner-occupied housing loan commitments in 2022 and low-income buyers will benefit most from modular refinancing services, as they come off their fixed rate cliffs. This is because they will be eligible for home loans with recalibrated serviceability buffer requirements, and according to their payment capacity even when the market rates for home loans are higher. Banks and lending institutions, in turn, will be able to cater to these overlooked borrower segments and increase their market share.

Furthermore, banks will be able to secure an even larger customer base with technologies like open banking and digital lending which will allow them to access borrower financial data securely and extend targeted offerings to them. Modular platforms can help banks better leverage open banking data to provide personalised loan offers by helping them develop associated interfaces quickly and enhance risk modelling.

Banks must revamp loan servicing with robust platforms to meet market requirements

Lenders are now thinking beyond regular customer acquisition & retention tactics (digital onboarding, rapid loan origination, competitive interest rates) now that borrowers are under financial duress owing to rising loan interest rates and inflation. They are increasingly looking at providing customers with an enjoyable loan servicing experience to earn loyalty.

So, loan approvals with a wait time of 4-6 weeks won’t cut it anymore. Neither will complicated loan servicing terms. Banks must streamline and automate loan processes to retain customers. And modular systems provide an agile and hassle-free way to go about it.

These systems allow lenders to use composable architectures to digitise and streamline their processes & workflows, helping with quicker loan servicing across all stages, along with customised loan lifecycle experiences through a robust platform.

Recent Blogs