Lending has become extremely competitive and managing borrower lifecycles has become imperative. Dichotomy has always prevailed between digitalising channels of origination at a hare-like pace or incrementally improving servicing & delinquency management through a slow-paced core transformation. However, at Pennant, we believe a platform-based approach is key to achieve success in today’s lending landscape. In this blog, we explore why.

It takes a crisis to drive the push towards core digitalisation in APAC banking.

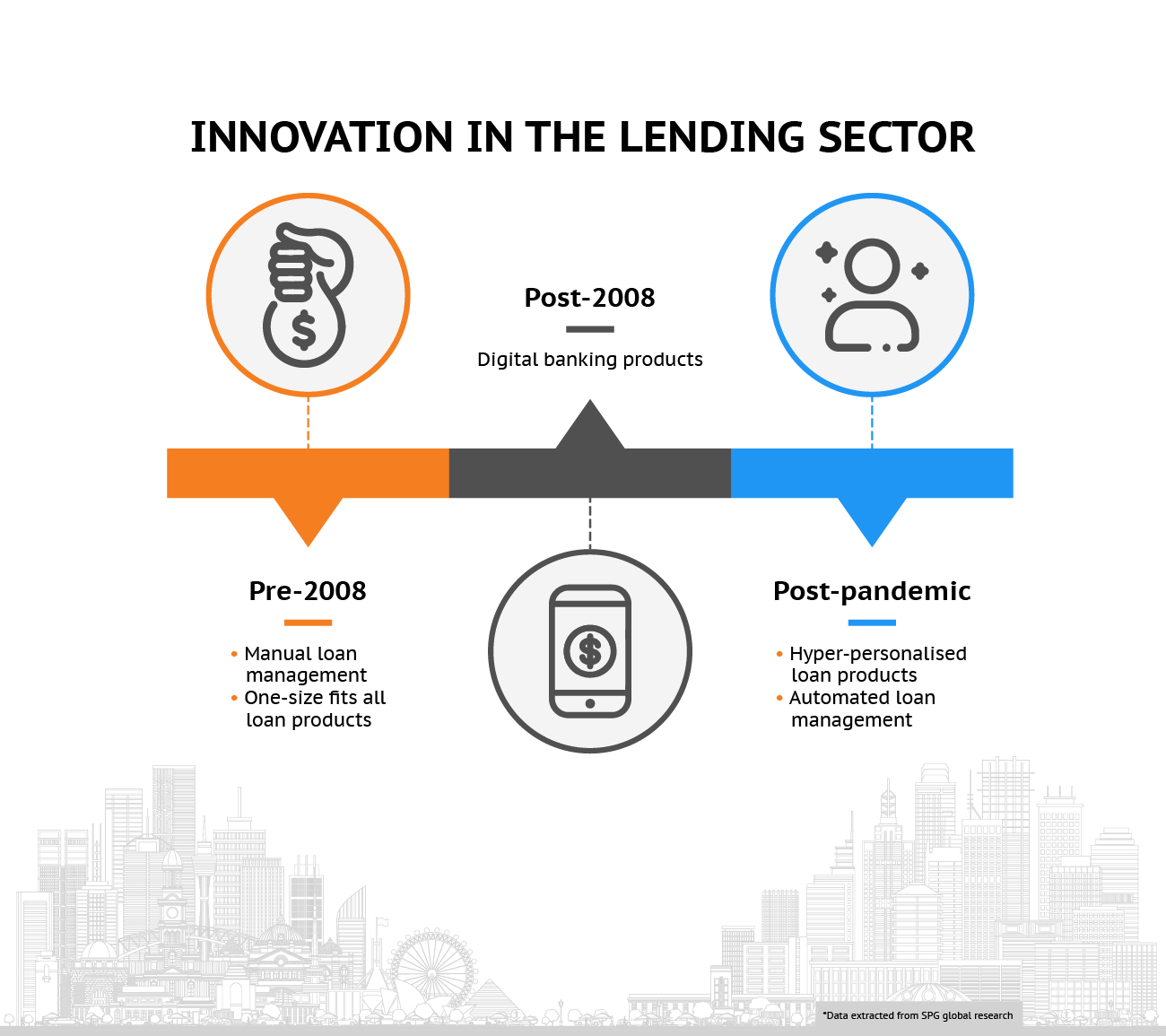

The first push for digitalisation came after the Global Financial Crisis of 2008. Banks had to make quick decisions to modernise their obsolete legacy systems through digital innovation – giving birth to digital banking products like digital home loans.

The second push came during the pandemic. The lockdowns and physical distancing mandates pushed the banks to manage loan lifecycles exclusively digital, resulting in a 200% increase in mobile banking logins.

The third, came after the pandemic. The subsequent rise in demand for digital borrowing options, coupled with the rising financial stress because of increasing interest rates, has created the perfect environment for the digital lending solutions to thrive, beyond conventional interventions in origination and cut across the lending lifecycle moments of truth for borrowers Heritage Banks, Non-Bank lenders and Mutual Banks have no choice but to find cost-effective and modular business cases for digitalising their existing systems to remain relevant.

Several banks began their digital transformation journeys before the third digitalisation wave. Commonwealth Bank of Australia, for instance, began revamping their core banking systems right after the financial crisis of 2008.

They implemented new IT infrastructure which used cloud computing and replaced traditional, monolithic and inflexible banking processes, giving way for automation, new offerings, standardisation, and real-time services. The bank even managed to reduce its spend on IT maintenance and reduce customer wait times.

Little surprise then that long-drawn CBA’s core systems modernisation process is still touted as one of the most successful transformation attempts to date. Contemporaries like Westpac and NAB have typically spent several challenging years transforming their core systems. FinTech operations and the operational load has also increased significantly, pushing banks to revamp individual core banking processes. This is perhaps why banks are now compartmentalising various banking functions, including lending, while incrementally modernising their core systems.

Even so, only 30% of financial institutions report undergoing successful digital transformation processes.

But why?

Challenges like tech overhauls, high costs, upended processes, and time for deployment continue to loom in the face of banking modernisation.

1. Outdated legacy tech

Over the years, banks have developed countless banking processes around complex core systems. Although reliable in the past and still very industrial strength in terms of resilience, traditional systems need adaptability and simplification of monoliths in the face of modern day banking needs.

Case in point, ANZ had problems owing to their complex core systems and processes in 2021, due to which their customers were unable to access their online accounts for several hours. Things could have been very different, had the Bank been able to have adaptive and simplified core platforms, where underlying functional complexity was decomposed from the core book of record systems.

To modernise processes, financial institutions must revitalise their core banking systems. They ought to introduce new complementing platforms , upgrade their hardware, software and networks and develop processes around the said technology, all of which require technical expertise, planning and skill. Not to mention, they must ensure seamless data migration, interoperability with other banking functions, and security and regulatory compliance.

2. Upended processes

Since traditional core banking functions are tied to one another, upgrading the system responsible for one process will most likely affect the flow of related processes. For instance, botched up data migration processes could lead to a loss of customer records, causing borrower distress as well as post-migration costs.

Members Equity Bank (ME Bank) witnessed the dangers of modernising their banking firsthand as they prepared to introduce their core banking system to their customers. Although the bank warned its consumers of a two-day outage and delays to the call centres following it, customers were also unable to access their accounts post the due date.

The short of it? Customers will face the brunt of a core systems upgrade and will hold your company responsible for a poor experience.

3. Budget constraints

Modernising to new technology is a cost-intensive effort even for banks that allocate big budgets towards core modernisation. More often than not, the actual costs overshoot planned budgets owing to expensive technology and higher spending associated with hiring new workers to man these new, modern systems. Little surprise then, that banks have historically been cautious before spending on a massive core systems transformation.

For instance, Westpac was reconsidering its digital transformation upgrade after its $18.6 billion merger with St. George Bank, owing to financial concerns. “You think honestly about the integration costs and finding enough capital to buy St George, and it’s probably going to put a challenge on anybody who wants to get a $600 million or $700 million business case approved to do a core systems replacement,” remarked an executive about the situation.

4. Revenue impact and deployment time variations

Most banks do not reap the benefits of their core transformation processes as quickly as the Australian Military Bank. Completing its core banking upgrade in a mere 10 months, the bank saw a 250% increase in mobile transactions just 12-months post the core-banking upgrade.

Other financial institutions typically undergo a core banking transformation spanning several years, while juggling high technological costs and a degradation of the customer experience during the duration of the upgrade. Although most of them witness benefits post modernising their core systems, it takes a while before banks can break through with the profits.

For instance, NAB deployed its personal banking origination platform PBOP eight years after beginning its core banking process. Only then did the bank see a reduction in the median time to fund personal loans and doubly quick credit card approvals.

Consumer lending surge to drive the lending modernisation beyond core banking upgrades.

Australia’s total consumer lending grew from 2131 billion AUD to 2161 billion AUD in 2023 alone, driven by demand for housing loans. Furthermore, the RBA also expects consumer lending to grow at a steady pace in the coming years. Events like the mortgage cliff will further drive refinancing and therefore give impetus to these borrower trends.

One way or another, banks are now expecting a surge in the demand for the restructuring and servicing of consumer loans and increased delinquency management , meaning they’re expecting a stress on their core banking systems., Gen Y is increasingly demanding instant loan servicing, pushing banks to upgrade their current lending systems. As Equifax Australia reports point out, “Lending is a key battleground for banks right now. They need to modernise their systems to improve the customer lifecycle experience through faster approvals, real-time underwriting, and more tailored product offerings as circumstances change dynamically.”

This is perhaps why at this point in time, more banks are looking to onboard a specialised platform for lending, similar to how institutions modernised their treasury and wealth management systems in the past.

Banks are now using specialised lending systems to streamline their loan processes across functions like loan origination, loan management, collections, and delinquency management while incrementally simplifying their core banking systems as a transaction book of record.

Banks implementing Loan servicing see better operational efficiency, quicker product development and deployment, and reduced product maintenance.

1. Increased operational efficiency

Loan servicing systems use loan software that work alongside core banking systems simplifying loan servicing. They automate, underwriting, restructuring, and maintenance while minimising errors and streamlining data management. This means, customer data can be retrieved and verified quickly, and documents can be managed effectively, cutting down the overall time and effort required to ensure an excellent loan borrowing experience.

2. Quick adaptability to changing customer preferences

As per a report, “Over 1.2 million Australians have accounts with a neobank, up from 600,000 just six months ago.” This rapid growth highlights the competitive threat these digital banks pose to traditional banks.

Traditional banks can retain their market share by offering customers personalised loan products through loan management systems. Since this tech sits on top of core banking processes, tweaking tech according to customer preferences is easier without impacting other banking processes. This helps banks develop helpful products quicker, allowing them to retain their customers better.

A pertinent example is Bank of Queensland that used a loan servicing system in 2015, reducing the turnaround time for loans to match customer preferences.

3. Lower cost for development, management, deployment and maintenance

Unlike modular core banking systems that require every new addition to the tech stack to integrate seamlessly with all existing elements, loan servicing systems can complement most tech stacks seamlessly. Many loan servicing system providers also allow banks a fair bit of customisation, not just in terms of UI but also in terms of custom workflows, analytics, and processes.

Furthermore, banks needn’t worry about maintenance or updates, given the vendor will make them available and deploy them as well.

The current economic conditions and changing customer preferences have pushed banks to modernise all their core banking functions, including lending. While some financial institutions are looking to make these upgrades incrementally by upgrading their core stack in phases alongside complementary loan servicing system capabilities, others are opting for a more comprehensive transformative approach by integrating end to end Loan lifecycle management platforms alongside core modernisations. One way or another, both approaches need to deliver personalised solutions that borrowers seek throughout the lending lifecycle.

Recent Blogs